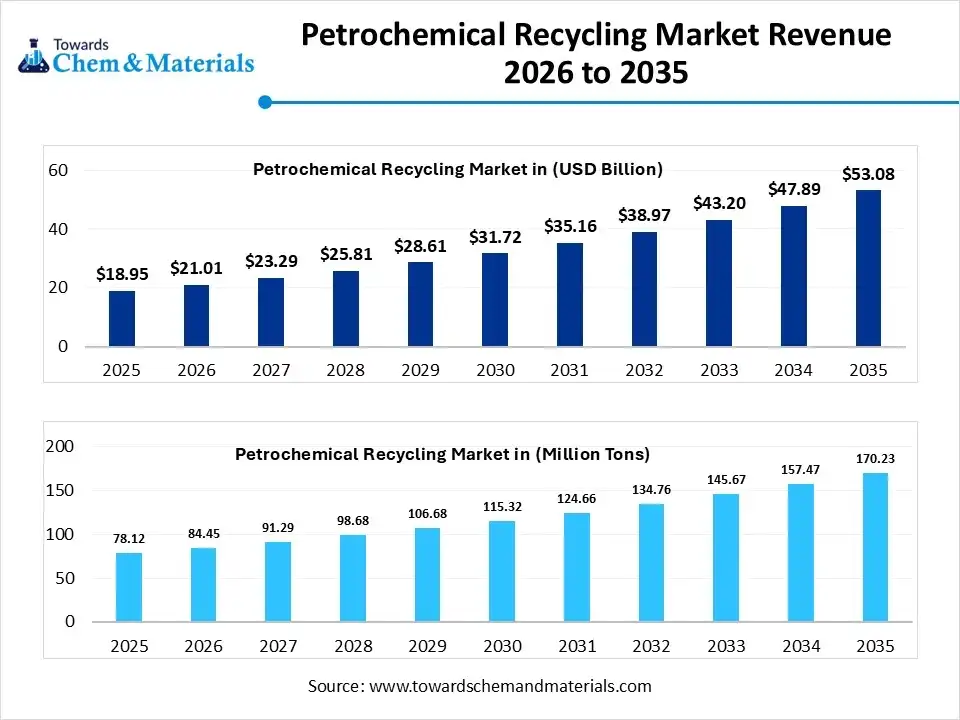

Petrochemical Recycling Market Volume to Worth 170.23 Million Tons by 2035

According to Towards Chemical and Materials, the global petrochemical recycling market volume was valued at 78.12 million tons in 2025 and is expected to be worth around 170.23 million tons by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.10% over the forecast period from 2026 to 2035.

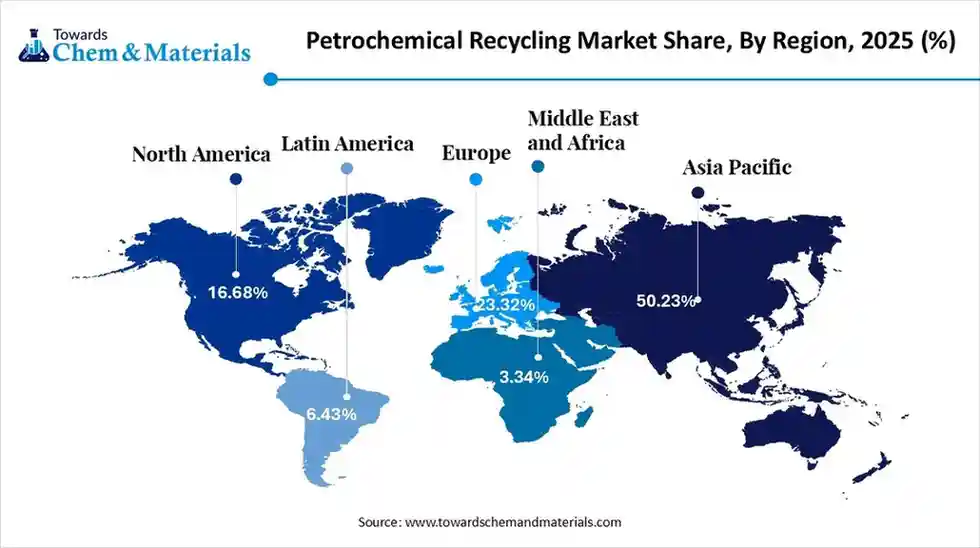

Ottawa, Jan. 14, 2026 (GLOBE NEWSWIRE) -- The global petrochemical recycling market size was estimated at USD 18.95 billion in 2025 and is expected to increase from USD 21.01 billion in 2026 to USD 53.08 billion by 2035, growing at a CAGR of 10.85%. In terms of volume, the market is projected to grow from 84.45 million tons in 2025 to 170.23 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 8.10% over the forecast period 2026 to 2035. The Asia Pacific dominated Petrochemical Recycling market with the largest volume share of 50% in 2025. A study published by Towards Chemical and Materials a sister firm of Precedence Research. The market expansion is supported by increased regulatory pressure on plastic waste management, circular economy goals, and the application of advanced chemical recycling technologies.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6120

What is Going on in the Petrochemical Recycling?

The petrochemical recycling market is shifting towards a value-centric circular model. The rising adoption of advanced chemical recycling technologies, directly applied to existing refining and cracker infrastructure to produce high-purity, virgin-grade circular feedstocks, is boosting the market. The government policies and stringent regulatory framework encourage sustainable design simplification, like mono-material packaging and leveraging AI-driven sorting to convert complex waste into high-value resources.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Petrochemical Recycling Market Report Highlights

- By region, Asia Pacific led the petrochemical recycling market with the largest volume share of over 50% in 2025. The growing support and sustainability initiatives drive the growth.

- By region, North America is expected to have fastest growth in the market in the forecast period between 2026 and 2035. The growing adoption and awareness fuel growth.

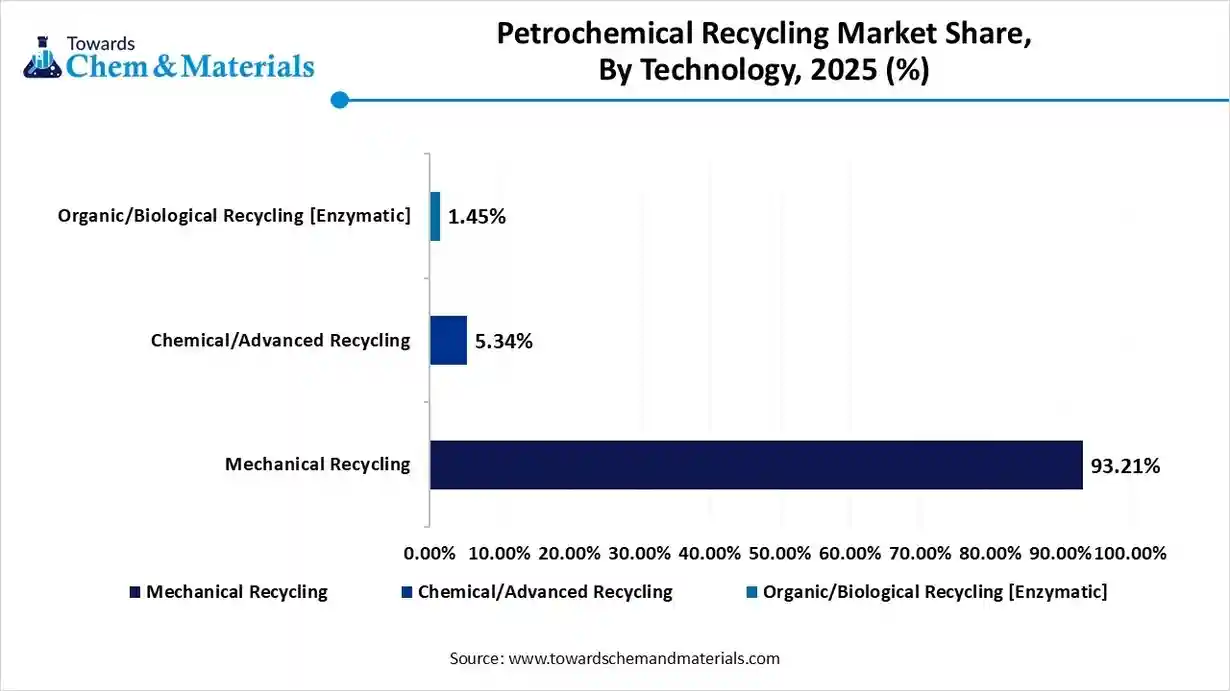

- By technology, the mechanical recycling segment led the market with the largest volume share of 93% in 2025. It is cost-effective and widely used for relatively clean driving growth.

- By technology, the chemical/advanced recycling segment is projected to grow at a CAGR between 2026 and 2035. Growing demand for circular feedstocks and regulatory support drives growth.

- By chemical process, the pyrolysis segment led the market with the largest volume share of 40% in 2025. Pyrolysis is gaining traction due to its ability to handle mixed plastic waste streams.

- By chemical process, the depolymerization segment is projected to grow at a CAGR between 2026 and 2035. Increasing brand commitments to closed-loop recycling are driving the adoption.

- By feedstock polymer, the polyethylene segment accounted for the largest volume share of 42% in 2025. Its high usage in packaging and consumer products increases the demand.

- By feedstock polymer, the mixed plastic waste segment is projected to grow at a CAGR between 2026 and 2035. This helps in reducing landfills, which increases the growth of the market.

- By application, the chemical feedstock segment dominated with the largest volume share of 45% in 2025. Growing regulatory pressure to reduce carbon intensity is encouraging petrochemical producers to adopt recycled feedstocks.

- By application, the new polymer production segment is projected to grow at a CAGR between 2026 and 2035. Brand-owner sustainability commitments and recycled content mandates are accelerating demand.

- By end-use industry, the packaging segment dominated the market and accounted for the largest volume share of 38% in 2025, increasingly used in flexible and rigid packaging, supporting the circular economy.

- By end-use industry, the textiles and apparel segment is projected to grow at a CAGR between 2026 and 2035. Rising demand for sustainable fashion and circular textiles is driving adoption.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6120

Petrochemical Recycling Market Report Scope

| Report Attribute | Details |

| Market size /volume in 2026 | USD 21.01 Billion / 84.45 Million tons |

| Revenue forecast in 2035 | USD 53.08 Billion / 170.23 Million Tons |

| Growth rate | CAGR of 9.4% from 2026 to 2035 |

| Historical data | 2018 - 2025 |

| Forecast period | 2025 - 2035 |

| Quantitative Units | Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2035 |

| Report coverage | Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Technology, By Chemical Recycling Process, By Feedstock Polymer Type, By Application, By End-Use Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

| Key companies profiled | Quantafuel (Norway/USA), Mura Technology (UK), Nexus Circular (Canada/Global), Plastic Energy (UK/USA/Global), BASF SE , Agilyx Corporation (USA), SABIC (Saudi Basic Industries Corporation) , Dow Inc., ExxonMobil Corporation, LyondellBasell Industries N.V. , Shell plc ,Eastman Chemical Company , INEOS Group, Neste Corporation , TotalEnergies SE , Indorama Ventures Public Company Limited , Chevron Phillips Chemical Company , Reliance Industries Limited , Braskem S.A. , LG Chem, Ltd. , SK Geo Centric (SK Innovation) , Borealis AG , Brightmark LLC , PureCycle Technologies, Inc |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments for Petrochemical Recycling:

- Reliance Industries Limited (RIL): RIL became the first Indian company to use advanced continuous catalytic pyrolysis technology to convert plastic waste into International Sustainability & Carbon Certification (ISCC)-Plus certified Circular Polymers like CircuRepol™ and CircuRelene™.

- ExxonMobil Corporation: ExxonMobil is investing $200 million to expand the capacity of its Baytown and Beaumont facilities using its proprietary Exxtend pyrolysis-based technology to convert hard-to-recycle plastic waste into feedstock for new plastics.

- Eastman Chemical Company: Eastman is a key player investing in advanced recycling technologies, specifically depolymerization processes, to break down complex plastic waste into its constituent monomers for repolymerization into high-quality materials.

- Carbios SA: Carbios specializes in a biological depolymerization process using enzymes to recycle PET plastics into their original building blocks (monomers), which can then be used to create virgin-quality plastic suitable for food contact applications.

- Mura Technology: Mura is developing and licensing its HydroPRS (hydrothermal plastic recycling solution) process, which uses supercritical water to break down mixed plastic waste into commercially valuable oil and chemicals, with investments and partnerships from companies like Mitsubishi Chemical and Dow.

- Plastic Energy: This company is a global leader in chemical recycling through its patented Thermal Anaerobic Conversion (TAC) technology, which converts end-of-life plastic waste into a recycled oil (TACOIL) used as feedstock by major petrochemical firms like SABIC and ExxonMobil.

- Brightmark LLC: Brightmark develops and operates plastics renewal facilities using a proprietary pyrolysis process to transform mixed plastic waste streams into new petrochemical products such as high-quality fuels and circular chemical feedstocks.

- Indorama Ventures: Through a joint venture with Dhunseri Ventures and Varun Beverages, Indorama Ventures is establishing multiple greenfield PET recycling facilities in India to produce recycled PET (rPET) resin and fibers, aiming for an annual capacity of 100 kilotons.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6120

What Are the Major Trends in the Petrochemical Recycling Market?

- Integration with Existing Infrastructure: The implementation of advanced recycling technology in the co-processing of feedstocks, integrating recycled materials into primary production loops.

- Rising Focus on Chemical Recycling: The substantial growth in chemical recycling methods, which break complex plastics down to their molecular level by allowing the processing of mixed and contaminated waste.

- Extended Producer Responsibility (EPR): The robust EPR frameworks are shifting the operational responsibility of post-consumer waste management to producers, supporting investment in recycling infrastructure.

Market Dynamics

Driver

How is the Regulatory Landscape Forcing Market Growth?

The transition towards secured recycled feedstocks to maintain the legal market for the products, enabling market growth. The transition is no longer optional, so the government is strengthening global regulations, including the Packaging and Packaging Waste Regulation (PPWR), Production Linked Incentive (PLI), and Extended Producer Responsibility (EPR), to boost domestic and global production.

Restraint

The material degradation and contamination are the primary restraints. Material degradation declines polymer quality while contamination makes it unsuitable for sensitive applications like food-grade or pharmaceutical packaging. Both factors require careful management and monitoring to ensure the effectiveness of recycling processes.

Market Opportunity

How can the Industry Unlock Value from Unrecyclable Plastic Waste?

The chief opportunity lies in deploying advanced chemical recycling technologies to process flexible, multi-layer, and contaminated plastics, scaling chemical recycling. By changing landfilled waste into high-purity monomers to meet the surging demand for virgin-quality recycled resins.

What is the Significance of the Digital Product Passport (DPP) Introduced Recently as a Technological Shift?

The DPP is a blockchain-based digital identity of materials. This technology enhanced traceability from raw material sourcing to end-of-life management and greenwashing. The key focus is to enhance transparency in supply chains and provide consumers with verified data by using technologies like blockchain, QR codes, or RFID tags. Overall, this technological shift facilitates the circular economy by providing key information for repair, reuse, and recycling processes.

Petrochemical Recycling Market Segmentation Insights

Technology Insights

Why did the Mechanical Recycling Segment Dominate the Petrochemical Recycling Market?

Mechanical recycling remains dominant as a key catalyst for the circular economy, offering a direct, energy-efficient route to material recovery. The widespread adoption of Design-for-Recycling principles that shift toward mono-material packaging optimizes waste streams for high-purity mechanical recycling, providing a stable supply of materials for several industries and enabling companies to meet regulatory and sustainability goals.

The chemical/advanced recycling segment is anticipated to grow fastest, transforming complex, contaminated plastics into high-purity molecular building blocks. Advanced technologies like pyrolysis and depolymerization produce virgin-grade circular feedstocks compatible with existing refineries, crucial for meeting the rising demand for food-safe and medical-grade recycled plastics. As industrial facilities scale up to meet stricter mandates, this segment bridges waste management and chemical production, becoming a critical investment area for a circular economy.

Chemical Process insights

Why Did the Pyrolysis Segment Dominate the Petrochemical Recycling Market In 2025?

Pyrolysis dominates the market by converting hard-to-recycle plastics into high-value liquid streams, circular naphtha that integrates with refinery infrastructure. This allows the industry to produce virgin-grade polymers meeting strict purity needs for food and medical applications, serving as a key link between waste management and chemical production for large-scale material circularity.

The depolymerization segment is expected to experience the fastest growth in the market. Offering precise molecular recycling for complex polyester and polyamide waste. Breaking polymers into monomers supports a limitless recycling loop without quality degradation, meeting the high standards of the textile and food industries. This technology is important for achieving high-performance circularity with minimal energy loss and expansion, fueled by the need for virgin-purity recycled resins.

Feedstock Polymer Insights

How did the Polyethylene Segment dominate the Petrochemical Recycling Market in 2025?

Polyethylene continues to lead the market due to its massive global production and recyclability in both mechanical and chemical processes. Its simple structure makes it ideal for pyrolysis, generating high-quality circular naphtha. The shift towards mono-material designs to meet sustainability targets, polyethylene provides a consistent waste stream for the entire recycling chain by targeting circularity.

The mixed plastic waste segment is projected to experience the fastest growth in the market during the forecast period. The growth is driven by large volumes of household and industrial waste unsuitable for traditional processing. The adoption of advanced chemical recycling transforms heterogeneous streams of multi-layer films and contaminated plastics into high-quality feedstock by enabling the scale required to meet sustainability targets and reduce reliance on virgin fossil fuels.

Application Insights

Which Application Segment Dominates the Petrochemical Recycling Market in 2025?

Chemical feedstock dominated the market, acting as the key link between waste recovery and industrial manufacturing. Its ability to transform waste into primary raw materials and produce recycled outputs like circular naphtha for existing steam crackers and refineries enables large-scale polymer production identical to virgin materials. The rising demand in various sectors is demanding high performance, such as durability with safety standards, and reducing fossil fuel dependency.

The new polymer production segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, by enabling circular plastics with performance identical to virgin materials. The market is fueled by sustainability commitments and recycled content mandates. By integrating recycled monomers into existing polymerization lines, supporting sectors like food packaging and healthcare. This technology bridges waste recovery and industrial production, serving the petrochemical industry to decouple its growth from fossil fuels.

End-Use Industry Insights

How did the Packaging Segment hold the Largest Share of the Petrochemical Recycling Market?

The packaging sector dominates the market as both the main feedstock source and primary user of recycled polymers. Packaging demands virgin-grade purity for safety and performance that fuels advanced chemical recycling in highly sensitive sectors like food and beverage. The industrial shift toward mono-material designs improves waste recovery, creating a standardized material supply that enables large-scale, cost-effective recycling, positioning it as a leader in the global circular economy.

The textiles and apparel segment is projected to grow at a CAGR between 2026 and 2035 in the market. The government incentives and policies, and investment infrastructure. The adoption of recycled polyester and other synthetic fibers in clothing, home textiles is driving this segment. The E-commerce growth and rising domestic consumption are key aspects for market expansion.

Regional Insights

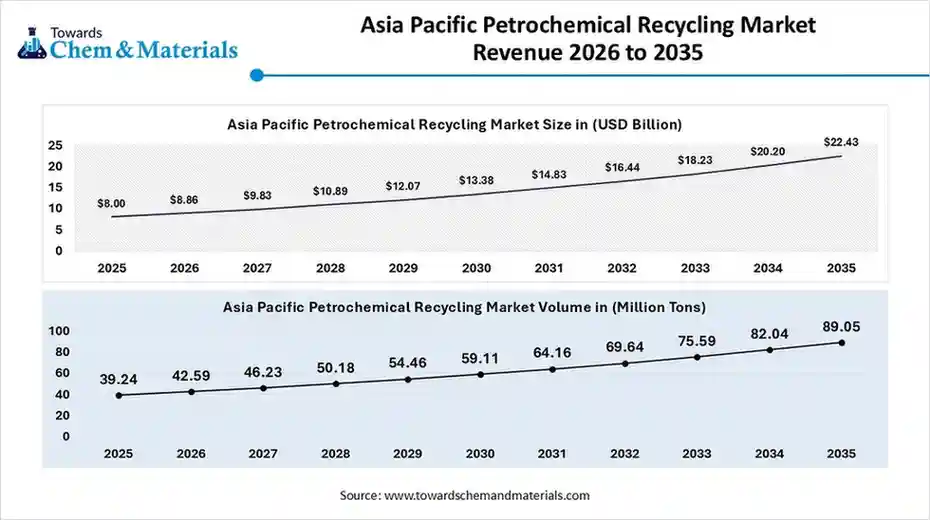

The Asia Pacific Petrochemical Recycling market was estimated to be USD 8.86 billion in 2025 and is projected to reach USD 22.43 billion by 2035, at a CAGR of 10.87% during the forecast period. By volume, the market is projected to grow from 42.49 million tons in 2026 to 89.05 million tons in 2035. growing at a CAGR of 8.54% from 2026 to 2035.

The Asia Pacific region leads globally by leveraging its role as a primary manufacturing and petrochemical hub to establish an extensive recycling infrastructure. As domestic policies shift from waste management to resource security, the region is rapidly adopting advanced technologies to meet high demand for sustainable polymers in the packaging and automotive sectors. This combination of abundant feedstock, industrial complexes, and circular economy policies makes the Asia Pacific the key driver for large-scale petrochemical recycling.

China Petrochemical Recycling Market Trends

China's market is growing rapidly as the government intensifies efforts to reduce plastic waste and promote a circular economy. Strong policy support and regulations are accelerating the adoption of chemical recycling technologies that can process complex and mixed plastic waste streams. Investments in advanced recycling methods such as pyrolysis, gasification, and depolymerization are increasing, driven by petrochemical companies seeking sustainable feedstock alternatives.

Why is North America the Fastest-Growing Region in the Petrochemical Recycling Market?

The North America petrochemical recycling market volume was estimated at 13.03 million tons in 2025 and is projected to reach 32.92 million tons by 2035, growing at a CAGR of 10.85% from 2026 to 2035. North America is the fastest-growing market, driven by strategic industrial investment and the deployment of advanced chemical recycling technologies. The growth is supported by integrated refining clusters modified to process circular feedstocks. The expansion is boosted by strict mandates and incentives for recycling hard plastics into raw materials, with major consumers moving toward domestic circular supply chains and sustainability. North America has become a key hub for innovation and commercialization in the petrochemical recycling value chain.

Its growth is supported by a mature recycling ecosystem, strong policy support, and active investments in advanced recycling technologies. Both established chemical recyclers and emerging companies are increasingly converting hard-to-recycle plastics into valuable chemical feedstocks, reinforcing the country’s leadership position in North America.

Canada Petrochemical Recycling Market Trends

Canada's market is gaining momentum as federal and provincial governments push circular economy policies and stricter regulations on plastic waste. Chemical recycling technologies such as pyrolysis and depolymerization are attracting increased investment to handle hard-to-recycle plastics and produce recycled feedstocks for petrochemical use. Major energy and petrochemical companies are partnering with technology providers to scale advanced recycling facilities and improve commercial viability.

Europe Petrochemical Recycling Market Trends

The Europe petrochemical recycling market volume was estimated at 18.22 million tons in 2025 and is projected to reach 37.98 million tons by 2035, growing at a CAGR of 8.50% from 2026 to 2035. The region’s dominance is driven by a highly developed regulatory environment and a strong commitment to circular economy principles. The EU has implemented comprehensive waste management policies and ambitious targets to reduce landfill use and promote recycled-content adoption, creating a favorable market environment.

Germany stands out as Europe’s leading market, driven by policy-driven investments in advanced recycling technologies. With significant support from both the public and private sectors, Germany continues to push innovation and enhance the efficiency of recycling systems, reinforcing its competitive advantage.

Latin America Petrochemical Recycling Market Trends

The Latin America petrochemical recycling market volume was estimated at 5.02 million tons in 2025 and is projected to reach 12.14 million tons by 2035, growing at a CAGR of 8.54% from 2026 to 2035. Growth is supported by increasing urbanization, greater awareness of sustainability issues, and rising pressure to manage plastic waste more effectively. The region is gradually adopting advanced recycling technologies to handle growing volumes of post-consumer plastic.

Brazil leads the Latin American market, driven by strong innovation efforts and active industrial involvement. Its well-established petrochemical sector and growing focus on sustainability have positioned Brazil as a key hub for chemical recycling development.

Middle East & Africa Petrochemical Recycling Market Trends

The Middle East & Africa petrochemical recycling market volume was estimated at 2.61 million tons in 2025 and is projected to reach 5.12 million tons by 2035, growing at a CAGR of 10.30% from 2026 to 2035. Rising urbanization, shifting consumer habits, and government sustainability agendas are driving interest in petrochemical recycling. Several countries are investing in infrastructure, policies, and pilot projects to reduce reliance on landfills and encourage resource-efficient recycling practices.

Saudi Arabia is expected to be the strongest growth market in the region. Its focus on expanding petrochemical capacity and integrating refining-to-chemicals operations provides an ideal foundation for establishing large-scale chemical recycling facilities.

More Insights in Towards Chemical and Materials:

- Petrochemicals Market Size to Hit USD 1,273.61 Billion 2035

- Performance Chemicals Market Size to Hit USD 582.98 Billion by 2035

- Sustainable Paper Chemicals Market Size to Hit USD 62.12 Billion by 2035

- Chemical Decarbonization Market Size to Surpass USD 665.56 Bn by 2035

- Carbon Capture Utilization Chemicals Market Size to Hit USD 527.01 Bn by 2035

- Chemical Recycling of Plastics Market Size to Hit USD 47.60 Bn by 2035

- U.S. Oleochemicals Market Size to Surpass USD 9.54 Billion by 2035

- Precision Chemicals Market Size to Hit USD 127.16 Bn by 2035

- Industrial Cleaning Chemicals Market Size to Surpass USD 81.97 Billion by 2035

- Nanochemicals Market Size to Surpass USD 43.93 Billion by 2035

- Chemicals Industry Market Size to Surpass USD 1,413.51 Bn by 2035

- Oilfield Chemicals Market Size to Reach USD 53.38 Bn by 2035

- Chemical Informatics Market Size to Hit USD 20.94 Billion by 2035

- Specialty Oilfield Chemicals Market Size to Hit USD 26.03 Bn by 2035

- Aroma Chemicals Market Size to Surpass USD 11.63 Billion by 2035

- Europe Water Treatment Chemicals Market Size to Surpass USD 20.66 Bn by 2035

- Industrial Water Treatment Chemical Market Size to Hit USD 32.34 Bn by 2035

- U.S. Agrochemicals Market Size to Surpass USD 42.69 Bn by 2034

- U.S. Construction Chemicals Market Size to Surpass USD 25.90 Bn by 2034

- Industrial and Institutional Cleaning Chemicals Market Size, Report 2034

- Water Treatment Chemicals Market Size to Reach USD 58.16 Bn by 2034

- Crop Protection Chemicals Market Size to Surpass USD 163.08 Bn by 2035

- Green Chemicals Market Size to Surpass USD 29.49 Billion by 2034

- Waterproofing Chemicals Market Size to Surge USD 15.23 Billion by 2034

- Commodity Chemicals Market Size to Hit USD 1,549.36 Bn by 2034

- Flame Retardant Chemicals Market Size to Hit USD 13.60 Bn by 2034

- Textile Chemicals Market Size to Surge USD 50.84 Billion by 2034

- Electronic Materials and Chemicals Market Size to Hit USD 145.17 Bn by 2035

- Froth Flotation Chemicals Market Size to Surge USD 3.26 Bn by 2034

- Lithium Chemicals Market Size to Surge USD 196.28 Billion by 2034

- Sustainability Chemical Market Size to Reach USD 161.73 Billion by 2034

- PFAS Free Chemicals Market Volume to Reach 905.32 Kilo Tons by 2034

- Boiler Water Treatment Chemicals Market Size to Reach USD 15.46 Bn by 2034

- Construction Chemicals Market Size to Reach USD 72.7 Billion by 2034

- Asia Pacific Sustainable Chemicals Market Size to Surge USD 59.74 Bn by 2034

- Asia Pacific Green Chemicals Market Size to Hit USD 139.20 Bn by 2034

- Europe Green Chemicals Market Size to Reach USD 11.23 Billion by 2034

- U.S. Green Chemicals Market Size to Reach USD 8.74 Billion by 2034

- U.S. Sustainable Chemicals Market Size to Hit USD 30.59 Billion by 2034

- U.S. Specialty Chemicals Market Size to Surge USD 303.05 Bn by 2034

-

Europe Petrochemicals Market Volume to Surpass 45.10 Million Tons 2035

Recent Developments in the Petrochemical Recycling Industry

- In January 2026, Reliance Industries launched an advanced material facility in Gujarat. The focus on manufacturing advanced composite and engineered plastics is pushing towards sustainability and technological solutions to support hydrogen and solar infrastructure.

- January 2025 – ExxonMobil Corporation announced the expansion of its pyrolysis facility in Baytown, Texas, doubling capacity from 40,000 to 80,000 tons per year. The project represents a $200 million investment and is scheduled to become operational by the fourth quarter of 2025. Once completed, the expansion will double ExxonMobil’s chemical recycling capacity in North America, supporting the rising demand for recycled petrochemical feedstocks.

- December 2024 –Eastman Chemical Company successfully commissioned its second solvolysis recycling plant in France. The new facility adds 50,000 tons per year of PET recycling capacity to serve European markets. Using Eastman’s proprietary molecular recycling technology, the plant produces virgin-quality, food-grade recycled materials that align with the EU’s stringent recycled-content mandates.

- November 2024 – BASF SE and Quantafuel ASA announced a strategic partnership to establish multiple chemical recycling facilities across Europe. The collaboration will combine BASF’s chemical and market expertise with Quantafuel’s advanced pyrolysis technology to scale up production of high-quality recycled petrochemical feedstocks and strengthen Europe’s circular economy infrastructure.

Petrochemical Recycling Market Share

The top 5 companies in Petrochemical Recycling industry include ExxonMobil Corporation, Eastman Chemical Company, Dow Inc., SABIC (Saudi Basic Industries Corporation), BASF SE. These are prominent companies operating in their respective regions covering 45% of the market share in 2025. These companies hold strong positions due to their extensive experience in petrochemical recycling market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- ExxonMobil Corporation is a multinational company that deals in energy and petrochemicals. The company focuses on exploring, producing, refining, and marketing oil and gas along with chemical products. The chemical division makes a broad range of polymers, synthetic rubber, and other petrochemical derivates for packaging, automotive, and industrial applications.

- Eastman Chemical Company is a global specialty materials company producing a wide range of advanced materials, additives, functional products, and specialty chemicals. It addresses and serves many industries such as packaging, transportation, building and construction, and consumer goods.

- Dow Inc. is a materials science company whose operational scope encompasses the markets of packaging, infrastructure, and consumer care. The range of products bearing the Dow brand includes performance materials, industrial intermediates, and plastics.

- SABIC (Saudi Basic Industries Corporation) is a global chemical manufacturing company with its base in Saudi Arabia and includes petrochemicals, chemicals, industrial polymers, fertilizers, and metals as core areas of operation for the company. SABIC has developed circular polymer solutions using chemical recycling and has integrated these materials into its established production systems.

-

BASF SE is a global chemicals giant operating in chemicals, materials, solutions for industries, surface technologies, nutrition, and agribusiness. The company's strategy for chemical recycling consists of ChemCycling initiatives, which turn recycled feedstocks into the rest of the production network.

Petrochemical Recycling Market Top Key Companies:

- ExxonMobil Corporation

- Eastman Chemical Company

- Dow Inc.

- SABIC (Saudi Basic Industries Corporation)

- BASF SE

- LyondellBasell Industries

- PETRONAS Chemicals Group

- Plastic Energy

- Agilyx Corporation

- Pyrowave Inc.

- Recycling Technologies Ltd

- Brightmark LLC

- Quantafuel ASA

- Carbios SA

Petrochemical Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Petrochemical Recycling Market

By Technology Type

- Pyrolysis technology

- Conventional pyrolysis systems

- Advanced pyrolysis with catalysts

- Microwave-assisted pyrolysis

- Depolymerization (chemolysis)

- Solvolysis processes

- Glycolysis for PET recycling

- Enzymatic depolymerization

- Catalytic depolymerization

- Gasification technology

- Air-blown gasification systems

- Oxygen-blown gasification

- Steam gasification processes

- Plasma gasification technology

- Dissolution & solvent-based recycling

- Selective dissolution technologies

- Solvent recovery & purification

By Chemical Recycling Process

- Pyrolysis (Thermal and Catalytic)

- Gasification

- Depolymerization (Chemolysis/Hydrolysis/Glycolysis)

- Solvolysis (Solvent-based Dissolution)

- Hydrocracking

By Feedstock Polymer Type

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Mixed Plastic Waste (Multi-layer and Contaminated)

By Application

- Chemical Feedstock (Naphtha, Aromatics, Olefins)

- New Polymer Production (Circular Plastics)

- Fuel Production (Diesel, Gasoline, Marine Fuels)

- Waxes and Specialty Chemicals

By End-Use Industry

- Packaging

- Food and Beverage Packaging

- Consumer Goods Packaging

- Industrial Packaging

- Automotive and Transportation

- Building and Construction

- Electronics and Electrical

- Textiles and Apparel

- Healthcare and Pharmaceuticals

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6120

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.